Work with subcontractors long term without using a payroll company

For the cost of a bacon roll per week, HardHats guarantees you can use your subbies long term and keep HMRC happy.

Grab your FREE copy of our book

“How To Use Subcontractors Long-Term & Keep HMRC Happy – Without Using A Payroll Company”

*we'll even pay the postage!

Grab your FREE copy of our book

*we'll even pay the postage!

Use your subbies long-term without upsetting HMRC

When you find subcontractors you can rely on, you want to keep hold of them. That doesn’t mean you have to employ them, and it doesn’t mean you have to work with payroll companies who take a cut of their hard-earned money.

There is another way.

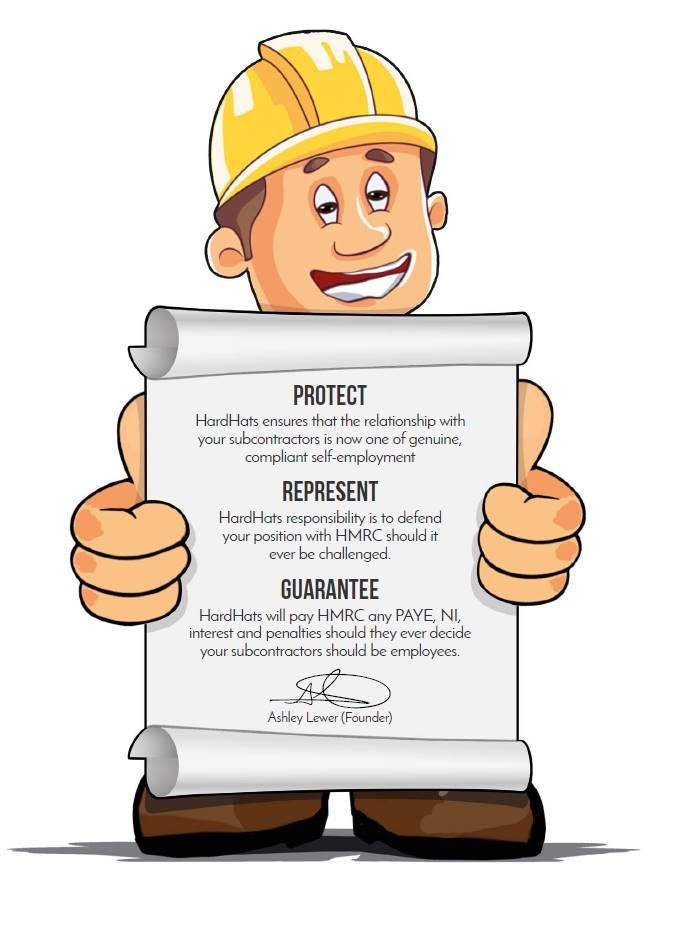

HardHats is the only company to offer a self-employed subcontractor guarantee specifically for construction firms. In other words, we take on your risk so you can get on with running your business.

What’s the catch?

There isn’t one. We know it’s hard to believe, but there is no catch. You pay us to take on your risk.

You tell us how you work with your subcontractors, we put together insurance-backed contracts for them to sign, and you get peace of mind for the next twelve months. After twelve months, we’ll do a quick review and renew your peace of mind for another year.

If HMRC ever reclassifies your subcontractors as employees, we pay any PAYE, NI interest and penalties. We take full responsibility for your subcontractors’ employment status, meaning you can use them for as long as you want.

You might not even need our help

Because of all the scare tactics out there, it’s easy to think you’re at risk, even when you’re not. That means there’s a good chance you don’t actually need our services, and if that’s the case, we’ll tell you.

But if you use labour-only subcontractors long-term and want to continue doing so, let’s have a chat. If you are at risk, we’ll take that risk off your hands.

Grab your FREE copy of our book

“How To Use Subcontractors Long-Term & Keep HMRC Happy – Without Using A Payroll Company”

*we'll even pay the postage!

Grab your FREE copy of our book

*we'll even pay the postage!

A partner you can trust

See what our clients say about working with HardHats.

Breaking down the bullshit

All you want is reliable subcontractors who will get the job done. All they want is to get paid for their hard work.

Simple right?

Or at least it would be if there wasn’t that little grey area – that fine line that differentiates the employed and self-employed.

The good news is the grey area isn’t actually that grey. In fact, we think it’s pretty black and white.

You don’t need to employ a subcontractor just because they wear your branded uniform on site – that’s just one of the many myths, misconceptions and blatant lies floating around. Fortunately, we’re here to help you separate fact from fiction.

Weighing up your options

We aren’t your only option so let’s take a look at how we measure up against the others

Take them on PAYE

Positives:

- You’ll be HMRC compliant

- You’ll have an obligated workforce

- You’ll retain control over your workforce

Downsides:

- There are additional financial costs

- There’s pressure to find on-going work

- You’ll be entitled to paid employment rights inc. holiday, sick, and maternity pay

Use a Payroll Company

Positives:

- You’ll have no relationship with subcontractor

- It’s free to use

- Streamlined back-office function

Downsides:

- It has a negative impact on cash-flow

- You lose control of payroll

- It’s expensive for subcontractors

Contract for Services

Positives:

- You retain control of payroll

- There’s no impact on your cash-flow

- And no additional financial costs

Downsides:

- It needs to be kept up to date

- There are risks of errors & HMRC challenging status of subcontractors

- It’s expensive to implement

Under the HardHats – who are we?

It doesn’t matter how many subcontractors you’ve got or how long you use them. It’s how you work with your subcontractors that determines whether they should be employed or self-employed.

After all, if a payroll company can pay subcontractors long-term and keep HMRC happy, so can you. You just need to know how – and that’s where we come in.

HardHats was founded to help frustrated contractors work with subbies long term without fearing a visit from HMRC or using payroll companies that eat into a subcontractor’s hard-earned pay.

Grab your FREE copy of our book

“How To Use Subcontractors Long-Term & Keep HMRC Happy – Without Using A Payroll Company”

*we'll even pay the postage!

Grab your FREE copy of our book

*we'll even pay the postage!